A precis

- FCA call for input – signposts the road ahead for AIFMs

- HMT Consultation – reviews and revises the UKAIFMR, enabling the FCA to establish a graduated and proportionate approach

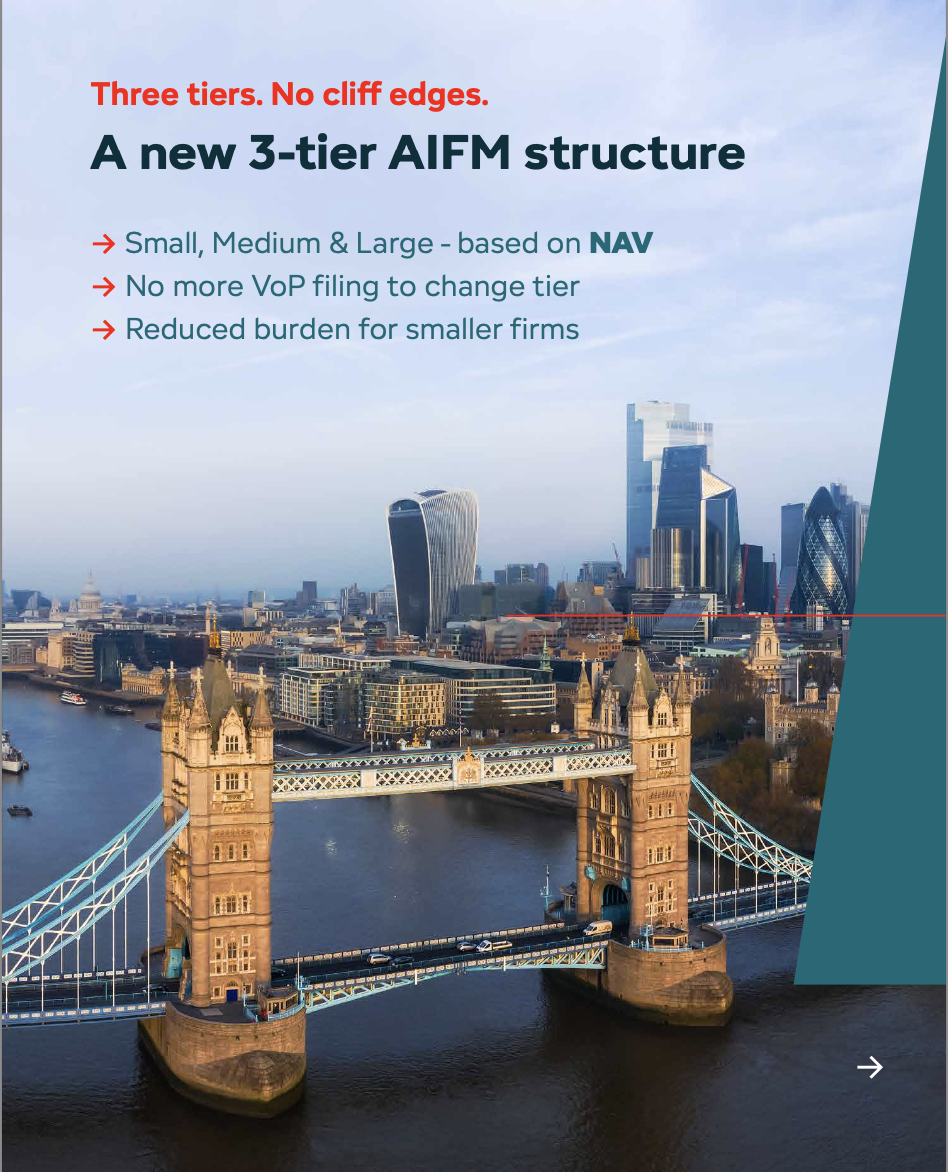

- A new three-tiered approach for AIFMs – small, medium and large (referencing NAV not Gross AuM)

- No VoP filing required for firms moving between tiers

- Thematic categorisation of rules to allow for better application by size, strategy (e.g., liquid vs illiquid) and risk (e.g., use of leverage)

- Approach to venture capital (including SEF and RVECA) managers to follow

- Specific approach for Investment Trusts

- Reduced obligations for most firms, particularly medium and small AIFMs

- Small registered regime abolished – full authorisation required for registered firms

- Valuation; strict liability for external valuers removed

- Minor change in depositary rules

- Notification obligations reduced, including removal of 20-day fund marketing notice and private equity control notifications

- Stay tuned for developments on conduct, remuneration, prudential and reporting

- A new domestic regime necessary for growth but EU alignment noted

Key references

- FCA Call for input. Future regulation of alternative fund managers

- HMT Consultation: Regulations for Alternative Investment Fund Managers

- FCA DP – Updating and improving the UK regime for asset management (DP 23/2)

The Detail

On April 7, 2025, the FCA issued the latest instalment on the review of the future regulation of alternative investment fund managers (AIFMs) and depositories. Like a streaming platform seeking to retain the extended attention of a dopamine engorged, impatient audience, the FCA Call for Input (CfI) offers the outline of an approach, though this time with enough hooks to suggest a discernible plot.

The CfI accompanies the HMT Consultation: Regulations for Alternative Investment Fund Managers (the ‘HMT Consultation’) which proposes to, inter alia, revise and remove elements from the UK Alternative Investment Fund Managers Regulations, so providing the FCA with the framework for storyboarding a new, flexible and growth focussed narrative.

The FCA first hinted at how it might operate within a revised regulatory framework in DP23/2: Updating and improving the UK regime for asset management, testing views on how the AIFM burdens could be reduced. Informed by feedback that supported a less complex, more proportionate regime that was still broadly aligned with the EU, the CFI sets forth proposals that retain in substance the existing UK AIFMD but in way that this is graduated in its scope and application.

Issues to address

Cliff edge effects

In the FCA’s estimation, the transition from a small sub-threshold AIFM to a full scope AIFM brings with it complex and burdensome regulatory requirements. Citing regulatory capital, depositary requirements and AIFM business restrictions (under Article 6(4) of the AIFMD) – which limit the conduct of additional (non-fund related) activities to those commonly referred to as the ‘MiFID- top-up’ – are all considered barriers to growth.

The shock of the abrupt application or ‘cliff edge effects’ of these requirements can be remedied with a proportionate framework of rules for smaller and growing firms. Further, and overall, given that AIFM size thresholds had not been reviewed since 2013, an opportunity arises to reconsider them and the rules that apply in each case.

Excess prescription

The surfeit of procedural requirements (many of which are in the AIFMD Level 2 regulations) speak sensibly to liquid strategies only and are, in any event, too prescriptive. Greater flexibility (in application) could achieve the same outcomes.

The medicine

A thematic categorisation of rules

The FCA plans to reorganize existing rules into clearer and simplified thematic categories based on different business activities and phases of firm and fund lifecycles, as follows:

- Firm Structure and Operation: Governance standards and basic systems requirements.

- Pre-Investment Phase: Rules for product design, development, and disclosure to prospective investors.

- During Investment: Ongoing obligations and periodic disclosures to investors.

- Event Driven rules: Requirements changes in funds or specific events requiring disclosure.

Tiered Regulatory Approach

In the context of that simplified framework, the FCA deems it easier to set rules for firms of different sizes and shapes. To wit, it proposes a three-tier system for firms based on Assets under Management (AuM):

- Large Firms. AuM £5bn>: A regime similar to current full-scope AIFM rules but with reduced prescriptive details and better tailoring of the rules by activity or firm type; for example, in regulator and investor disclosure.

- Mid-Sized Firms. AuM £100m to <5bn: Covering all areas as currently detailed in FUND 3, SYSC and COBS chapters of the FCA Handbook but with less prescription and greater activity based rule application. The FCA also promises a scaling back of obligations found in the AIFMD Level 2 Regulation for this cohort. Overall, Mid-sized firms are promised a ‘removal of rules across the board’.

- Small Firms. <£100m AuM: Only the core baseline standards would apply. As such, small firms would see a significant reduction in detailed and prescriptive requirements.

Frictionless movement

Free of legislative thresholds, the FCA would no longer mandate a variation of permission for firms needing or indeed seeking a change in category. Instead, a notification would suffice. Firms would be free to ‘opt-up’, which the FCA observes may be beneficial for those conducting (EU) cross border business. It is noteworthy that EU alignment remains prominent in the FCA’s thinking.

Out with the Gross, in with the NAV

Importantly, current AIFMD thresholds contemplate leverage and the use gross exposure when assessing an AIFM’s AuM. The CfI suggests that the more commonly used Net Asset Value (NAV) is a better and less complicated measure. The FCA promises further discussion at a later date of leverage and how it should be risk assessed – including risk management systems and obligations for highly leveraged strategies.

Different (regulatory) strokes for different folks

To applause from the gallery, the FCA concede that the AIFMD Level 2 Regulations do not translate readily for those running illiquid strategies. The CfI offers simple but welcome examples (in Annex I) of how the FCA might differentiate the high-level risk management standards and detailed risk rules contained in Level 2 for AIFMs by both size and strategy (i.e., liquid and illiquid).

Venture capital

The FCA is considering tailored frameworks for specific sectors, such as venture capital firms, further to the promised HMT review of the Sef and RVECA regulations, recognizing their unique operating models and contributions to growth.

Investment trusts

The FCA also recognises the uniqueness of investment trusts, though there is no intention to except them from the new regime. However, the CfI proposes to disapply many obligations including those pertaining to disclosure (in FUND 3.2 and 3.3) and curtailing those regarding delegation, leverage and risk according to specific AIFM characteristics.

Small registered regime consigned to history

Amidst this bonhomie is a sobering corollary for those in the Small Registered regime. In removing the legislative thresholds in the UKAIFMR, the HMT Consultation acknowledges that the small registered regime will become redundant and so the firms in it – excluding managers of SEF or RVECA funds the regime for which the government will review at a later date – will need to be authorised by the FCA. The total population of small registered firms is circa 145 and, in essence, benefit from a very lite registration only regulatory framework. Representing only <11% of the overall AIFM population, managing <0.3% of total net asset value it is, nonetheless, a big price to pay for a small number of firms.

Depositaries

An important, and not to mention costly aspect of AIFMD compliance is depositaries and associated functions thereof. In the round, the FCA considers the protections here remain valuable but is considering some changes. Firstly, given the growth of private markets the FCA sees merits in requiring a depository (specifically) to fulfil the function of safekeeping for non-custodial assets. Secondly, the removal of cash flow monitoring for unauthorised funds with professional investors only. Wisely, depository obligations would not apply to Small AIFMs (for whom the CASS 6 rules would remain).

Bonus crowd pleasers

Both the HMT Consultation and the CfI conclude with a number of bonus, rule bonfire proposals and the promise of additional content, as follows:

HMT Consultation

Marketing notifications:removal of theneed to notify the FCA 20 days prior to marketing an AIF acknowledging the futility of this obligation.

Private equity (control) notifications: Deletion of obligations to the FCA regarding notice upon acquisition of control of assets listed issuers (Under Chapter V, Section 2 of the AIFMD). With perhaps unfortunate candour, HMT acknowledge that the FCA has no power to act on ‘issues’ in private equity that these rules were designed to mitigate, such as asset stripping.

External valuation: To encourage the market for external valuers, the HMT Consultation proposes to remove the legal liability that such providers have to the AIFM, and indeed the concept (of liability for the negligent performance of the valuation task) entirely.

CfI cliff hangers

The CfI promises further substantive discussion of several other key topics and how they might be differentiated in the context of the proposed new tiers of AIFM, including on remuneration, prudential and ‘regulatory reporting’ (presumably under ‘Annex IV’ of the AIFMD). As noted, the CfI also considers the AIFM business restriction to be unduly costly and inefficient and is, therefore, another thread to be pulled.

Closing thoughts

With the publication of the CfI and the HMT Consultation, one can now properly discern regulatory intentions regarding a domestic, proportionate and growth enabling (!) UK regime for AIFMs. The three-tiered model is bold, the tailoring by strategy very much welcome, and the thematic categorisation and approach to rule making is something familiar to the FCA and all market participants.

The approach taken explicitly acknowledges the need to remain broadly aligned with the EU AIFMD. Whilst any move introduces friction and the special irritation of similar but different obligations, the final proposals should not result in barriers to growth for all firms regardless of their size and profile: be they larger firms pursing cross border business or small registered firms facing the complications and burden of full FCA authorisation and regulation.

The detail in the devil of the oft repeated flexible and proportionate refrain is something we should look forward to given that now, at least, we have a story to follow. The CfI is open for comment until 9th June 2025, with consultation on the final rules expected in H1 2026. The topic is highly important to the alternative space and will form a core part of the FCA work and supervisory strategy for alternatives, as well as its five year strategic plan.

Blueprint GRC will be paying close attention as the story unfolds, please let us know if you should like to engage on this topic and we would be glad to talk.