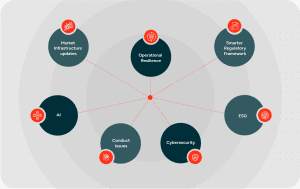

Those who believe in telekinesis, raise my hand said the wise Kurt Vonnegut. Belying this witticism was Nihil Rathi with his dutiful response to Keir Starmer’s request for the Financial Conduct Authority (FCA) to support economic growth see here for Blueprint’s Insights on the topic. In considering how to interpret the FCA’s many and multifarious objectives and strategies, it is so very easy to lose sight of the essentials; to miss the music amidst the white noise. So, what is the FCA doing that will have a tangible impact on the alternative asset management sector; and how should compliance officers be responding?

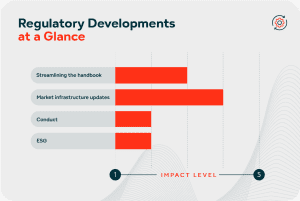

Streamlining the handbook – technical updates and more?

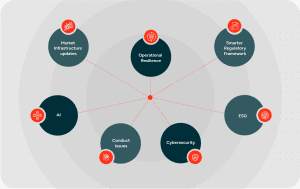

Under the ‘Smarter Regulatory Framework’ initiative launched as part of the Edinburgh Reforms and associated Future Regulatory Framework (FRF) Review, the Financial Services and Markets Act 2023 repealed retained EU law relating to financial services, with the objective of, inter alia, simplifying the complex interplay between legacy EU directives and FSMA and giving the FCA increased powers to make targeted changes including streamlining the handbook.Overlapping and duplicative directives

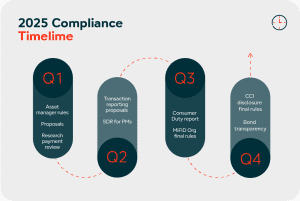

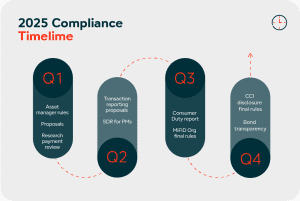

DP23/2: Updating and improving the UK regime for asset management addressed core rules governing fund and asset management; namely, AIFMD, UCITS, and MIFID, and spoke to the overlapping and duplicative nature of specific obligations thereunder such as conflicts of interest and heterogenous conduct obligations pertaining to investment due diligence, mandate compliance and liquidity. Regarding the UK AIFMD specifically, the FCA is considering the rules for different types of AIFM (i.e., small versus full scope and leveraged versus un-leveraged) and, indeed, the virtues of those distinctions. Event driven reporting and obligations thereon was also noted. One might expect a follow-up on the AIFMD aspects of the consultation in 2025, including further to EU AIFMD II developments which have no direct bearing on UK AIFMs but may influence FCA thinking. Action. AIFMs to keep their eyes peeled for updates. The thresholds (and concomitant rule distinctions) between small and full scope managers are under review.

MIFID Org Reg

In November 2024, the FCA issued CP24/24: The MiFID Organisational Regulation on the transfer of the MIFID Org Reg, which contains core systems and controls and conduct obligations, into the FCA handbook. The intention is simply a re-statement of the rules as they stand but options for an ‘immediate opportunity for rationalisation’ are presented, to address the different but practically inconsequential drafting derived from the MIFID, AIFM and UCITS Directives. This rationalisation includes rules on conflicts of interest, personal account dealing and best execution. As an aside, an EU review of the latter topic will likely set new expectations for the scope and review of best execution policies in 2025 which UK firms may also consider noteworthy. The FCA is also considering the rather aged client categorisation rules; including a strengthening of the opt-up process, and a clarification of the (unduly convoluted) corporate finance contact rules. The Article 3 UK MIFID Optional Exemption regime in its entirety is under review given that there is limited practical difference in the application of the MIFID II derived rules for such firms. The primary impact of the complete dissolution of the distinction (between MIFID and Optional Exemption firms) is the (unanswered) question of what that means from a prudential perspective. Some firms have elected to become Optional Exemption firms so as to fall outside of scope of the Investment Firms Prudential Regime. One to watch. Action. All firms. Remain abreast of the consultation and be prepared to make the requisite updates to manuals and policies and procedures on a regular basis. Nothing speaks so readily to a stale compliance environment than obsolescent manuals and policy documents. Optional Exemption firms: seek to contribute to the discussion with regards to the prudential rules that would apply, should the distinction and indeed the regime in full fall away.Goodbye KIID/KID hello…

The FCA is consulting on a new disclosure framework for retail investment products to replace PRIIPS; the so-called ‘Consumer Composite Investments’ (CCI). CCIs are products with returns that are dependent on the performance of underlying or reference assets and include products in scope of the current PRIIPS and UCITS regimes. All CCIs must be replete with a product summary (replacing the PRIIPs KID and UCITS KIID) whenever it is or can be distributed to a retail investor. The new rules are a response to the unloved KID and KIIDs documents, but the transition will, of course, require a material effort for those conducting retail business. The final rules are expected in 2025. Whilst the CCI proposals do not directly affect or alter the MIFID cost and charges disclosure obligation, the FCA is promising to review those (MIFID) obligations at a later date, to ensure that the respective requirements do not conflict. MIFID firms should also bear in mind the CCI proposals pertaining to cost calculation methodologies, given that the (PRIIPS methodologies) were referenced in widely utilised industry guidelines and standards propagated by TISA). Action: Firms currently subject to PRIIPS should commence initial project planning for the new CCI disclosure.Market infrastructure updates

MiFIR Transaction reporting

The FCA’s discussion paper on transaction reporting (DP24/2) seeks to ‘improve the usefulness’ of the regime through improved data quality – a long standing issue and concern – and a proportionality review of the reporting taxonomy. The paper considers, inter alia: the complexity of the reporting of OTC derivatives and how this may be simplified (or made more complex in the changing!); guidance on the concept of instruments traded on a trading venue (TOTV); and the impact and applicability of the regime on/to UK Branches and firms with low trading volumes. Also being considered (here and in the EU) is the long-standing exemption from MIFIR transaction reporting for AIFMs with MiFID tip-up permissions. Presently the FCA appears minded to retain the status quo. The FCA do not propose to streamline the rules overall through fear of increasing divergence with comparable regimes. The risk, though, remains very much alive given the EU’s own ruminations on the matter. Action: All MIFID investment firms should consider the impact of the proposed changes on their reporting systems and procedures and also consider the noted data quality issues (including top five reasons for rejected trades noted in Chapter 2).Transparency in the bond and derivatives markets

The changes to transaction reporting can be seen in the context of a number of other market infrastructure reforms such as the new consolidated tape for bonds which, it is hoped, will finally see daylight at the end of the year. The UK’s new bond and also derivative transparency regime (as finalised in in PS24/14: Improving transparency for bond and derivatives markets) is intended to support price formation and best execution and is part of the growth agenda trumpeted (or parroted) by Rathi. Action: Whilst it is likely that the burden of the new transparency regime will fall on trading venues and sell side firms, MIFID Investment manager firms trading fixed income and derivatives firms should review the new transparency obligations. The operational requirements and, indeed, the front office impact of the consolidated tape for bonds must be on the list of priority actions for H2 of 2025.Investment research

Further to the research rules published in July of 2024, an option was created for managers to use joint payments for the purchase of third-party research and execution services, provided that certain guardrails (policy, budgeting and cost allocation, disclosures), be implemented. As a contributor to growth and competition, the action achieved little as the market had moved on in many respects. However, those now re-setting research payment budgets for 2025 – and in particular, those facing off with US brokers – may find the option worth re-exploring. On a related point, the new rules added to the list of minor non-monetary benefits ‘short-term trading commentary’, so allowing managers to receive such from US brokers dealers (without the latter triggering SEC investment adviser registration requirements). Action: Firms to ensure research payment review and evaluation processes are refreshed for 2025.Conduct Issues

The Consumer Duty

In the section noted ‘Reducing the Regulatory Burden’, Rathi announces the removal of the obligation to ‘Consumer Duty Board Champion’, though any significant changes appear unlikely to what is a cornerstone initiative for the FCAs supervisory strategy. The market has wrestled with what the ‘Duty’ really means in practice and firms preparing for the second annual Consumer Duty Board Report should welcome the good practice guide published by the FCA in December 2024. Readers are advised to pay especial attention to the guidance on the (proportionate) application of the Duty for small firms and the five areas of improvement. Action: All firms in scope of the Consumer Duty to commence review and completion of the second iteration of the Consumer Duty Board Report.SM&CR

The 2023 review of the Senior Managers and Certification Regime (SM&CR) remains ongoing; one that has been complicated by the vexed topic of non-financial misconduct. The to-be concluded Crispin Odey episode is the latest and most high profile and we can expect further developments – or in the very least discission – on the issue (of non-financial misconduct). How the government pursues consumer protection and regulatory burden reduction imperatives will be essential viewing. Firms should remain apprised of the FCA’s publications on the matter (including the October 2024 survey findings on non-financial misconduct) and consider how such may be incorporated into policies, internal (senior management) reporting, and staff training. Action: SM&CR hygiene should remain a top priority for all. All firms to ensure SM&CR tasks such as statements of responsibility review, attestations and certifications, and training are concluded.